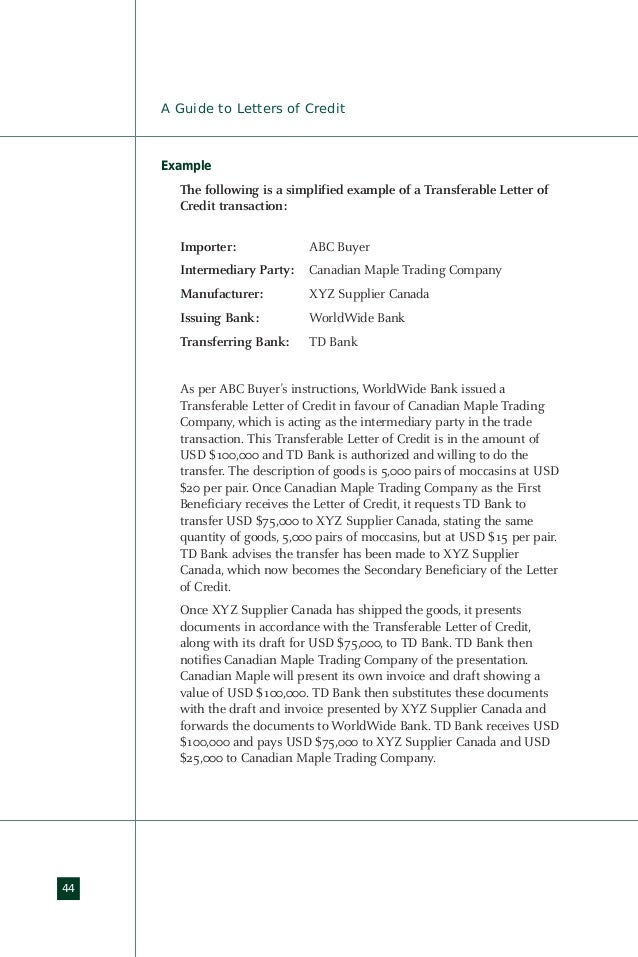

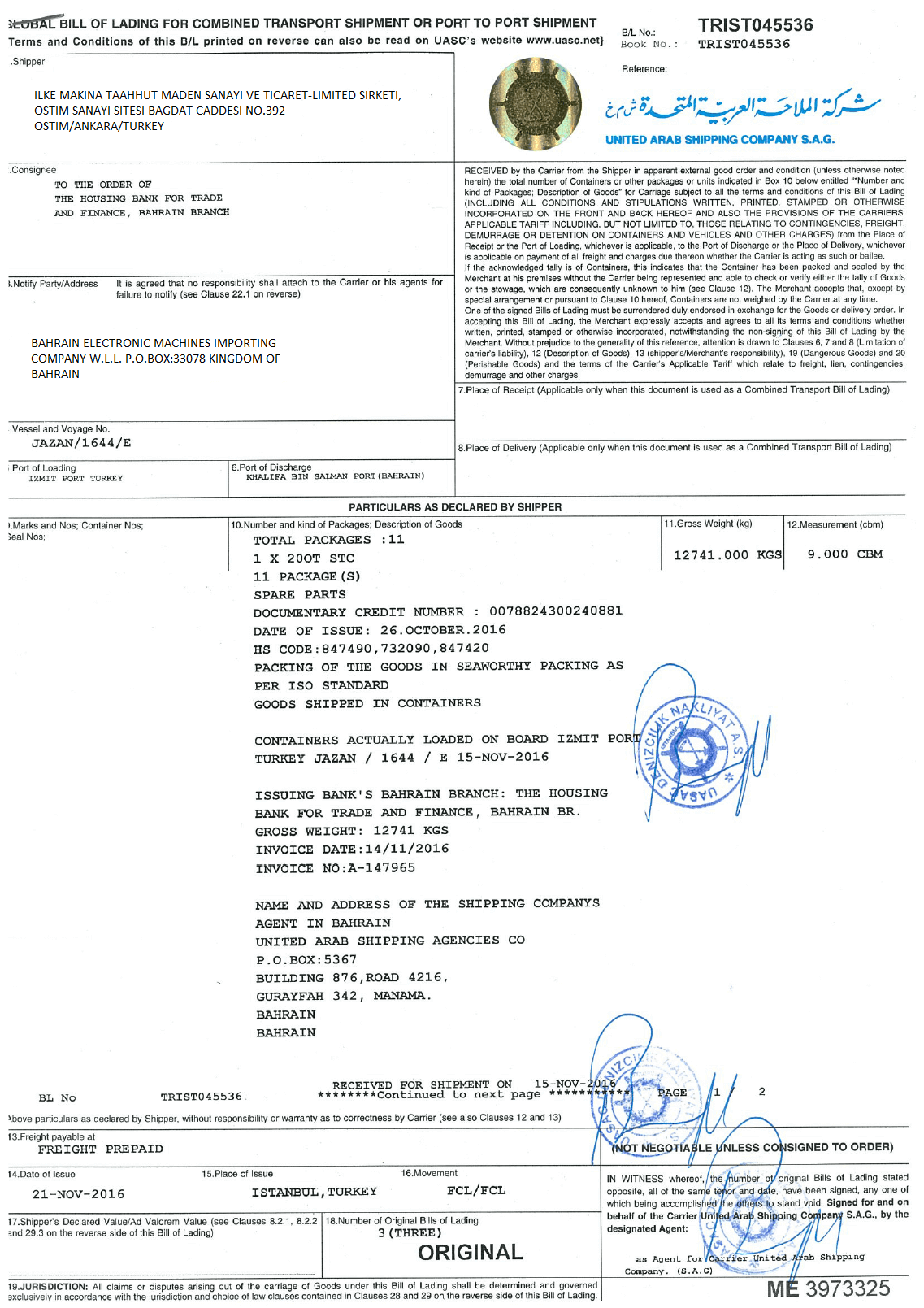

Example Letter Of Credit. It is letter from a bank or any other financial organization with whom an individual or company has banked with for a period of time that proves that the individual or company has a good credit record. Since a letter of credit is a negotiable instrument, the issuing bank pays the.

Letter of Credit, as being defined by Investopedia, is widely used for international exchanges as guarantees as well as an important assurance, particularly to the sellers that will be be paid for a large transaction.

Letters of credit are most common in international transactions, where buyers and sellers may not know each other well or laws and conventions may make certain transactions difficult.

If you are an individual in need of a letter of credit, download our example so that you are familiar with what they are looking for. Discover credit letters written by experts plus guides and examples to create your own credit letters. Until you actually use the letter of credit for a business transaction, it's an off-balance sheet disclosure.

/GettyImages-638953282-5b48eb4346e0fb0054c4e12a.jpg)