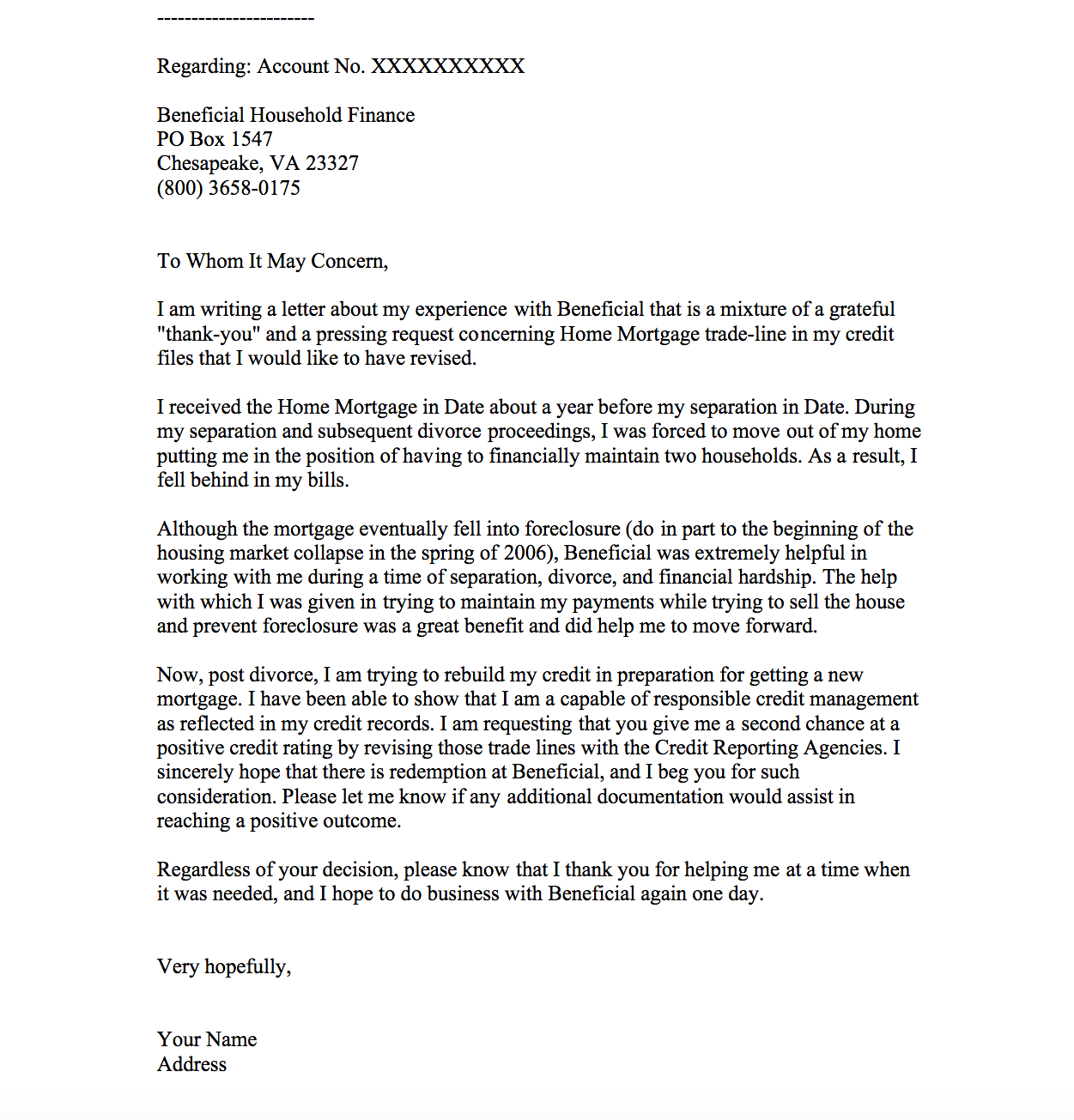

Sample Letter Of Explanation For Mortgage Credit Inquiries. Sometimes, lenders also ask for a letter of explanation for mortgage to ask for clarification on issues such as insufficient funds charges on a checking account. In a letter of explanation for your mortgage application, you may need to account for any late payments, collection accounts, judgments or bankruptcies on your credit history.

While credit inquiries are typically the least A hard inquiry is often the result of an application for credit, like a home mortgage or an auto loan.

It's a legal document which gives authority to an individual.

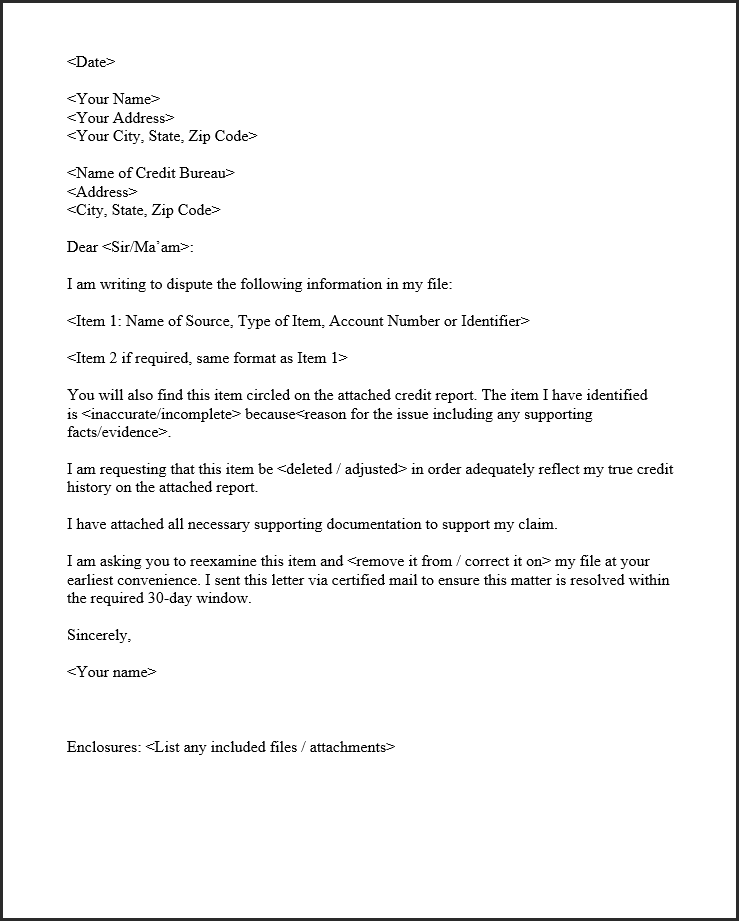

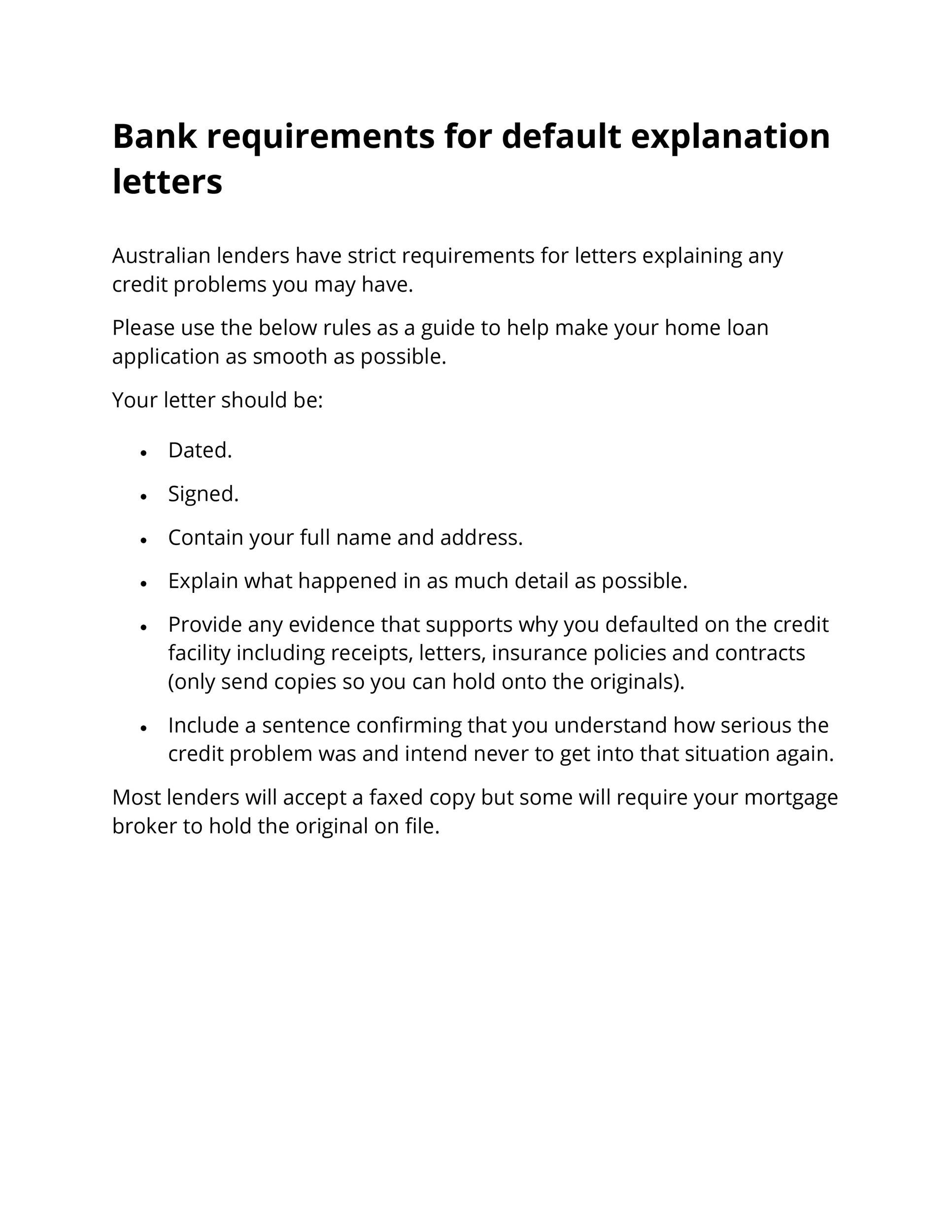

Use our default explanation letter template to explain why you have arrears, missed payments, a default, judgment, or bankruptcy on your credit file. Although mortgage credit checks count as a hard inquiry on your credit reports and may impact your credit score Here's a sample of a uniform mortgage application. You've probably applied for either of those at some.