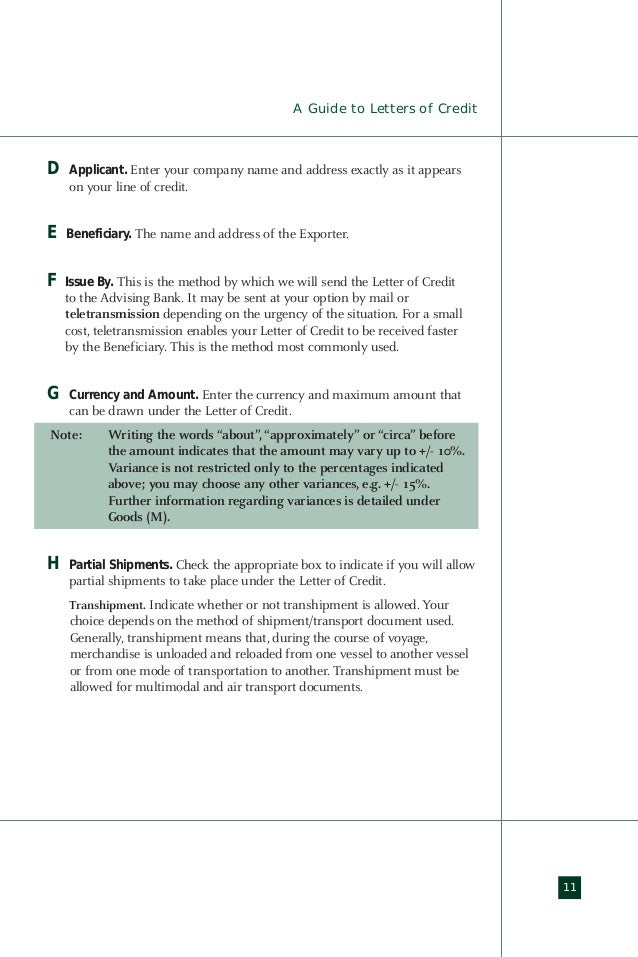

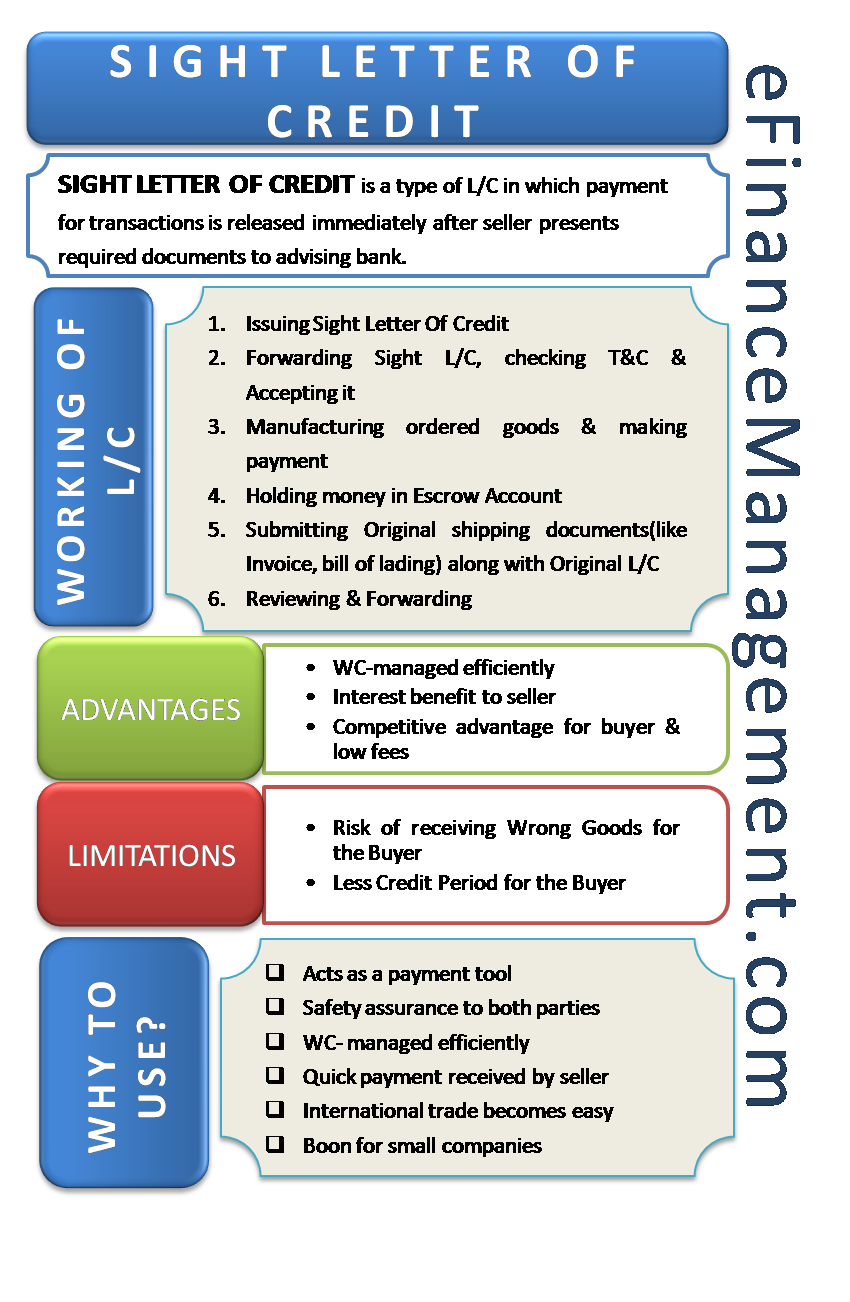

Letters Of Credit. Banks issue letters of credit when a business "applies" for one and the business has the assets or credit to get approved. A letter of credit that demands payment on the submission of the required documents.

Letter of credit is a written commitment from a bank guaranteeing that a buyer's payment to the seller will The use of a letter of credit has become a very important aspect of international trade.

It is Issued by a bank and ensures the timely and full payment to the seller.

An unconfirmed irrevocable letter of credit provides a commitment by the issuing bank to pay In addition, if a letter of credit were a revolving one, there were few ways to stop it from rolling over; so. The bank reviews the documents and pays the beneficiary if the documents meet the conditions of the letter. A letter of credit, or "credit letter" is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount.