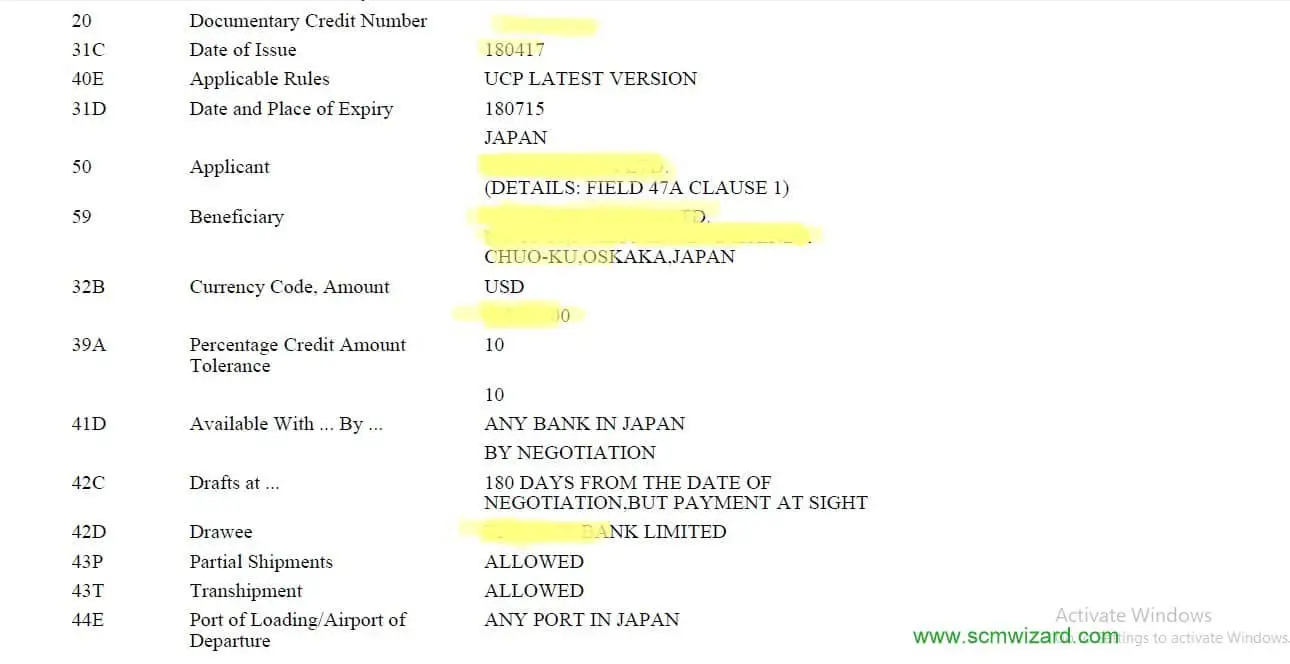

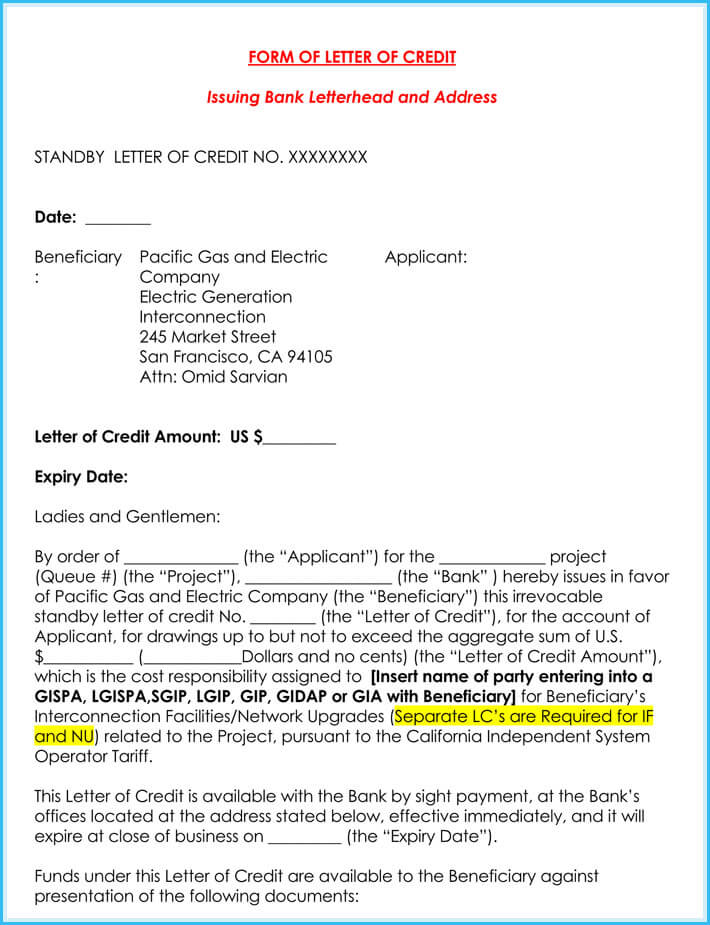

Letter Of Credit. A letter of credit is a more complicated financial transaction than those you might be more accustomed to, but it might be the best course of action for your business at some point. The bank reviews the documents and pays the beneficiary if the documents meet the conditions of the letter.

Commercial Letter of Credit Commercial letters of credit have been used for centuries to facilitate payment in international trade.

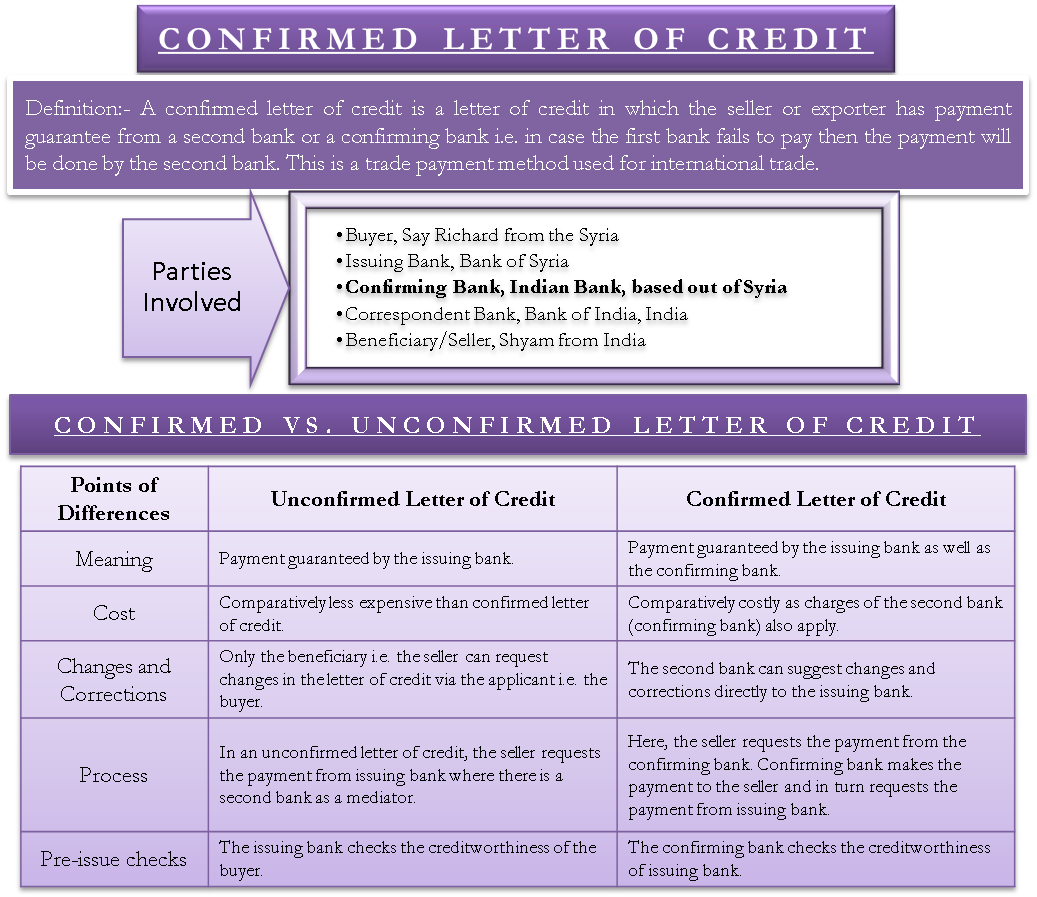

A letter of credit is a method of payment, considered less secure than payment in advance but more secure than documentary collections and open account from the seller's point of view.

A letter of credit provides protection for sellers (or buyers). Letter of Credit is one of the safest mechanisms available for an exporter to ensure that he gets his payment correctly and the importer is also assured of the exporters adherence to his requirements. Their use will continue to increase as the global economy evolves. letter of credit definition: a letter from a bank asking that the holder of the letter be allowed to draw specified sums of money from other banks or agencies, to be charged to the account of the writer of.